Local

President Solih appoints Special Representative to oversee investigation into terror attack against Speaker Mohamed Nasheed.

-

World7 days ago

World7 days agoChina rejects U.S., Japan, Philippines concern about South China Sea

-

World6 days ago

World6 days agoUnder professed ideals lies Washington’s pursuit of hegemony

-

News5 days ago

News5 days agoVoting begins for the parliamentary election 2024

-

News5 days ago

News5 days agoECM urges to vote independently and promptly

-

News6 days ago

News6 days agoOver 100M spent from state finances for the ruling party’s campaign: Solih

-

News5 days ago

News5 days agoPresident casts ballot in parliamentary election

-

News4 days ago

News4 days agoMDP fails to defend several seats in parliament

-

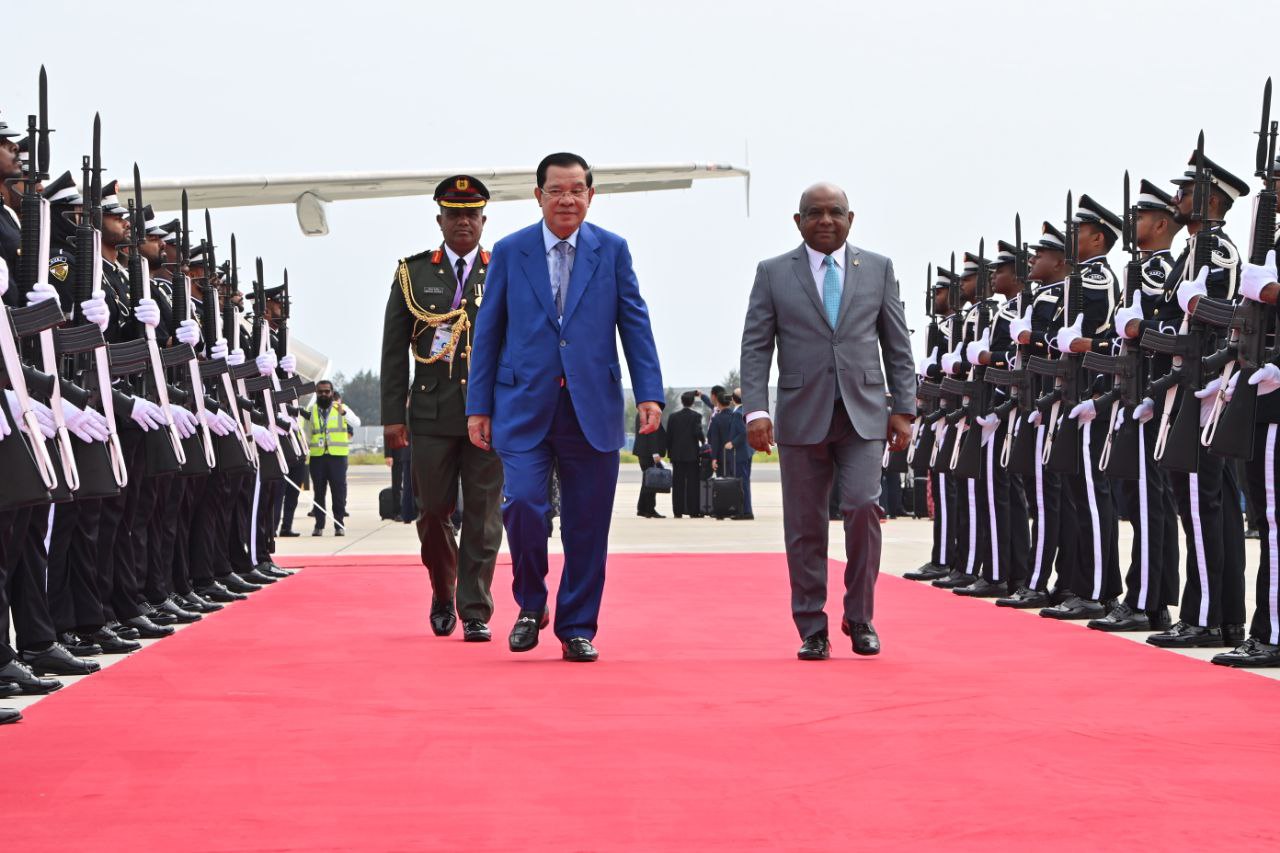

News6 days ago

News6 days agoThis is a golden opportunity to cooperate with a government: President